The Buzz on Home Equity Loan copyright

Table of ContentsNot known Incorrect Statements About Home Equity Loan copyright The Buzz on Home Equity Loan copyrightThe Main Principles Of Home Equity Loan copyright See This Report about Home Equity Loan copyright5 Easy Facts About Home Equity Loan copyright Explained

The major disadvantage, nevertheless: You would certainly be placing your home on the line for an optional expense. This can be risky if you don't have a solid strategy to repay the finance. It also adds rate of interest to an expenditure that really did not have interest to begin with, ultimately costing you a lot more.If you need capital, you could be able to conserve cash on rate of interest by taking equity out of your home instead of taking out a service funding.

A return on financial investment isn't guaranteed, and you're placing your residence on the line. It's possible to make use of home equity to invest in the stock market or buy a rental residential property though both propositions are risky and call for severe treatment and consideration.

The 2-Minute Rule for Home Equity Loan copyright

Taking a trip can come with a steep price tag, and touching your home's equity could help cover the expenses without having to boost your debt card financial obligation. Also the ideal trips do not last for life, however, and home equity financial obligation can stick around for years, so consider your decision carefully.

It can be. You can deduct home equity car loan rate of interest if you utilize the funds to "get, construct or substantially enhance" the home that was utilized to protect the funding, according to the IRS. You need to make a list of deductions on your income tax return, and comparable to the home mortgage reduction there are limitations as to how much you can subtract.

These can include several of the same closing prices as Click Here a typical real estate closing, such as source, evaluation and credit record charges. HELOC loan providers also often bill annual charges to keep the line open, as well as a very early termination charge if you close it within three years of opening.

The Basic Principles Of Home Equity Loan copyright

A home equity car loan is a finance obtained on a home that currently has a main home loan. Your look these up house works as security for both the main home mortgage and the home equity financing; failing to repay either can cause the loss of the residential or commercial property. A homeowner might take into consideration obtaining a home equity finance if they need accessibility to a swelling sum of cash, however don't want to market their residence.

Similar to a routine home loan you'll need to apply and get approved for a home equity finance. When approved, you'll receive a single lump-sum quantity. You'll pay back the quantity with a dealt with or continue reading this variable price of rate of interest over an established size of time, called a term. You're liable for making regular payments on both your initial and second mortgages simultaneously.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Kelly Le Brock Then & Now!

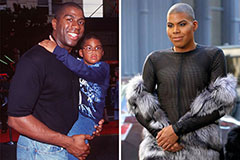

Kelly Le Brock Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!